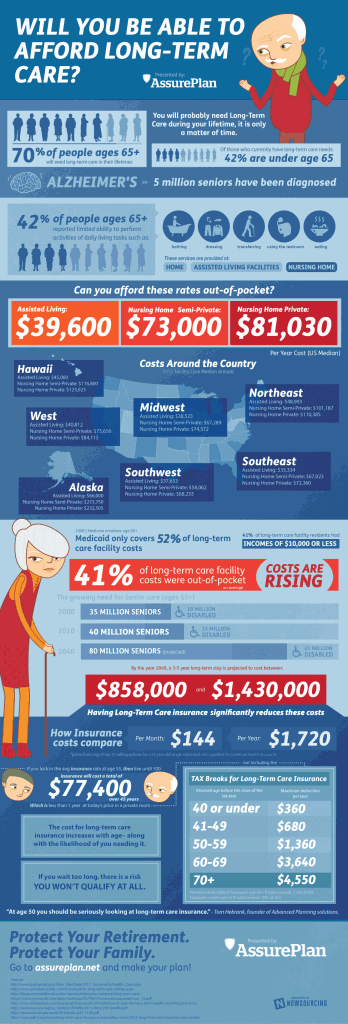

Learn more about the importance of acquiring long-term care in the infographic below, presented by AssurePlan.

Will You be Able to Afford Long-Term Healthcare? [Infographic]

The costs and need for long-term care are rising, and it is important to protect your retirement, and your family from large costs. It is highly likely that you will require long-term care in your lifetime – 70 percent of people ages 65+ will require long-term care, and out of those who already have long-term needs, 42 percent of those are below age 65. Medicaid only covers 52 percent of long-term care facility costs; and on average 41 percent of costs are paid out of pocket. If you acquire insurance earlier rather than later, you can spare yourself of many costs and risks.